Apple: Time To Face The Harsh Reality (Downgrade) (NASDAQ:AAPL) – Technologist

Nodokthr

Apple Inc. (NASDAQ:AAPL) is slated to release its fiscal first quarter or FQ1’24 earnings report on February 1. Apple holders will have the opportunity to parse the success of its holiday season sales, as Apple took the crown of the world’s “top smartphone maker” in 2023, surpassing arch-rival Samsung (OTCPK:SSNLF). Based on AAPL’s market outperformance over the past year, which delivered a total return of almost 36%, I believe the market has already reflected the optimism.

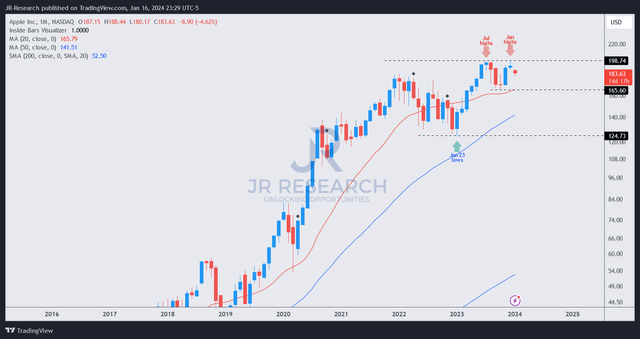

As a result, I urge investors to focus on the Cupertino company’s growth opportunities and challenges over the next year to assess whether AAPL can still outperform in 2024. AAPL suffered robust selling pressure at the $200 level after re-testing it in mid-December 2023. Consequently, AAPL fell to the $180 zone in early January 2024 and has continued consolidating at that level. I assessed recent dip buyers were likely attracted to buy AAPL’s pullback. However, I will explain why I have decided to downgrade AAPL, as the fundamental challenges, overextended valuation, and price action are much less constructive at the current levels.

Apple’s recent battle with Masimo Corporation (MASI) on the “blood oxygen feature on its smartwatches” shouldn’t be surprising. The discussion on whether Apple has infringed on Masimo’s patents has been ongoing for a few years. In any case, Apple engineers are likely working around the clock to tweak its software and algorithms to circumvent the recent ruling and potentially get the Apple watches back on track.

However, even if it doesn’t, we shouldn’t rule out the possibility that Apple could still negotiate an agreement with Masimo out of court. Masimo seems open to such a settlement, so I assessed the damage to Apple’s innovation engine as limited. Given its robust free cash flow profitability (FY24 estimates: 27.3%), I don’t expect Apple’s finances to crumble since it doesn’t affect its core profit driver (iPhone).

With healthcare an increasingly important focus of Apple’s services strategy, investors are rightfully concerned whether it could affect the continued strong adoption of Apple’s smartwatches, given its market leadership. Despite that, we shouldn’t simply associate AAPL’s recent selloff with its legal battle with Masimo (an ongoing matter). With AAPL’s market outperformance over the past year, profit-taking at a critical resistance level ($200) should be expected. Hence, AAPL holders shouldn’t overreact to negative media sentiments and understate Apple’s ability to overcome these issues.

However, China’s continued weak spending and a potential lack of massive stimulus to help spur economic growth in 2024 could prove to be a notable stumbling block. Chinese Premier Li Qiang presented at the World Economic Forum at Davos that China surpassed its 5% GDP growth target in 2023. Moreover, Li stressed that China’s achievement was “without resorting to massive economic stimulus measures.” Li’s commentary wasn’t well-received, as Chinese equities suffered a steep selloff (as of January 17 Asian-trading hours). The market isn’t convinced that China would resort to an extensive stimulus campaign, notwithstanding the ongoing malaise in its property market and persistent deflationary impact.

Moreover, Apple reportedly offered “rare iPhone 15 discounts in China.” It’s possible that Apple could face more intense competitive pressures from its rivals, including the resurgence of Huawei’s offerings. Jefferies had cautioned that Apple’s China iPhone sales in 2023 “may have dropped 30% after Huawei introduced the Mate 60 series.” As a result, AAPL’s growth valuation could come under more scrutiny in 2024 as investors assess whether its valuation could have been too optimistic.

Investors will need to assess the momentum of Apple’s AI efforts, as Apple seems relatively late compared to Microsoft (MSFT) and Google (GOOGL) in the AI game. Even Amazon (AMZN) has stepped up its efforts to protect its lead in cloud computing, as generative AI in smartphones is expected to be the next frontier between Apple and its Android peers. Counterpoint Research forecasts that “more than a billion smartphones with built-in generative AI will ship by the end of 2027.” As a result, Samsung has intensified its efforts to seize the initiative, given the enthusiasm and potential for generative AI at the edge. I expect Apple to provide more insights in this year’s WWDC as it looks to protect its iOS walled garden moat from its arch-rivals looking for an opening.

Furthermore, Microsoft and Intel (INTC) have also intensified their efforts on the AI PC, attempting to blunt the recent challenges from Apple’s Mac. However, the PC upgrade cycle will likely gain momentum in 2025. Therefore, it should allow sufficient time for Apple to respond and secure its recent gains against its Windows-based rivals. With generative AI going mainstream as custom GPTs are being launched and proliferated, I believe Apple must promulgate its AI strategy clearly this year, or the market could sideline it.

If these challenges aren’t enough to worry CEO Tim Cook and his team, Apple must also ensure its Vision Pro retail launch is successful. Meta Platforms (META) is ready to ride on Apple’s coattails with its more “affordable and accessible” headset. Bloomberg reported that Apple has prepared an elaborate demo, said to last “as long as 25 minutes.” As a result, it’s Apple’s “most sophisticated sales pitch ever,” suggesting that Apple sees it as a pivotal long-term growth driver. However, I don’t expect Vision Pro to be a critical near-term profitability driver until Apple is confident in launching its mass-market version. As a result, the optimism surrounding Vision Pro’s success could be premature as investors attempt to price in its growth optionality.

AAPL price chart (monthly) (TradingView)

With that in mind, AAPL’s 2024 could prove to be much more challenging, given its outperformance over the past year. I gleaned that AAPL’s double top bull trap (validated in July 2023) wasn’t decisively overcome in its early January 2024 re-test. In other words, AAPL’s $200 resistance level has proven to be a critical distribution zone, attracting profit-taking.

Given the failed re-test, as AAPL sellers regained the initiative, I concluded it was timely to move back to the sidelines. AAPL’s “F” valuation grade supports my caution. While AAPL’s long-term uptrend bias is expected to remain intact, I assessed outperformance in 2024 could prove to be challenging at the current levels, given the challenges raised earlier.

AAPL investors looking for an opportunity to add more exposure should assess whether its October 2023 lows ($165 level) could hold if it pulls back further. If bullish momentum at that level is validated, investors can consider buying more when it comes closer to that zone.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/EZRMZMPBZXVURAV3PXZWUMQFX4.jpg)