Apple Should Make Better Decisions To Ensure Their Excellent Business Continues (AAPL) – Technologist

ozgurdonmaz

Introduction

The Justice Department filed a complaint against Apple (NASDAQ:AAPL) on March 21, 2024. It clearly shows Apple has an excellent business. The legal system will decide what it shows with respect to antitrust violations. My thesis is that Apple should make better decisions moving forward in order to extend the durability of their business.

Apple’s fiscal year goes through the last Saturday of September.

Financial Considerations

The numbers for Apple from the last five years show they have an excellent business ($ in millions except Basic EPS):

|

Basic EPS |

Net income |

Net margin |

FCF |

Operating income |

Gross profit |

Gross margin |

Sales |

|

|

FY19 |

$2.99 |

$55,256 |

21% |

$58,896 |

$63,930 |

$98,392 |

38% |

$260,174 |

|

FY20 |

$3.31 |

$57,411 |

21% |

$73,365 |

$66,288 |

$104,956 |

38% |

$274,515 |

|

FY21 |

$5.67 |

$94,680 |

26% |

$92,953 |

$108,949 |

$152,836 |

42% |

$365,817 |

|

FY22 |

$6.15 |

$99,803 |

25% |

$111,443 |

$119,437 |

$170,782 |

43% |

$394,328 |

|

FY23 |

$6.16 |

$96,995 |

25% |

$99,584 |

$114,301 |

$169,148 |

44% |

$383,285 |

Many other companies out there would relish the thought of more than doubling EPS in four years while having a margin which is 1/4th of sales.

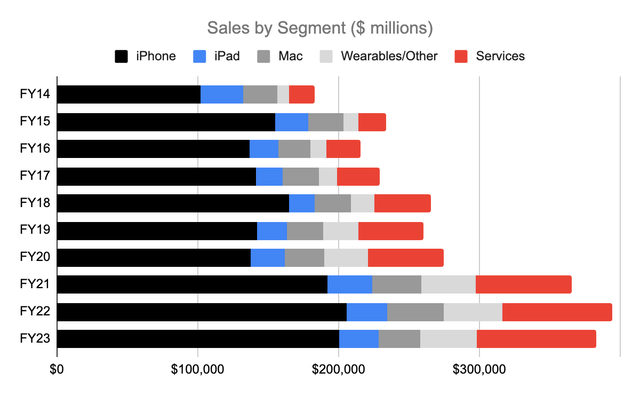

Segment Sales

It is important to put the sales segments in perspective before going through the reasons as to why Apple is such a great business and why they need to make better decisions in certain areas. The Wearables/Other segment increased from 4.6% of revenue in FY14 to 10.4% in FY23. The Services segment has also increased over the years, going from 9.9% of revenue in FY14 to 22.2% in FY23. These segments couldn’t be more different. The Wearables segment is important not only for the direct revenue it brings but also because it encourages people to stay in the iPhone ecosystem. The Justice Department complaint spells this out (emphasis added):

In a 2019 email the Vice President of Product Marketing for Apple Watch acknowledged that Apple Watch “may help prevent iPhone customers from switching.” Surveys have reached similar conclusions: many users say the other devices linked to their iPhone are the reason they do not switch to Android.

Apple is greedy with the Services segment and this causes resentment from everyone along with antitrust accusations from the government.

Looking at the last 10 years, the Wearables/Other segment has grown prodigiously from sales of $8.4 billion in fiscal 2014 to sales of $39.8 billion in fiscal 2023:

Segment sales (Author’s spreadsheet from 10-K filings)

The iPad segment has shrunk a little bit and the Mac segment has been fairly flat. The Wearables segment above has a 9-year CAGR of 18.9%. The Services CAGR is also right up there at 18.8% but again, the EU and the US Justice Department are taking actions which put this segment in jeopardy.

Apple’s Excellent Business

The Justice Department complaint is loaded with details about the advantages Apple enjoys. Apple and Samsung (OTCPK:SSNLF) dominate the US smartphone hardware market and Google (GOOG) (GOOGL) is a distant third. 90% of the smartphone revenue in the US goes to Apple and Samsung. History has shown significant barriers to entry in the US smartphone market. Less than 10% of smartphone purchases in the US are from customers buying their very first smartphone. As such, it is hard for newcomers to get a foothold because existing Apple and Samsung customers can be reluctant to try something which isn’t established. Amazon (AMZN) failed to gain traction with their Fire mobile phone in 2014. Microsoft (MSFT) gave up on their mobile efforts in 2017. HTC exited the space by selling their business to Google in 2017. LG left the market in 2021.

Ever since the iPhone came out, Apple has built and sustained the most dominant smartphone platform and ecosystem in the US and Apple is on the high end of the smartphone market relative to Samsung. The Justice Department complaint refers to the high end of the market as the performance market and it says Apple’s US share is over 70%. The complaint says iPhone device profit margins are more than 30% which are higher than the percentages we see from Samsung. The Justice Department complaint discusses specifics (emphasis added):

Apple’s per-unit smartphone profit margins are far more than its next most profitable rival. Apple charges carriers considerably more than its rivals to buy and resell its smartphones to the public and employs contract clauses that may impede the ability of carriers to promote rival smartphones.

Apple’s dominance in the US should continue for a long time seeing as 1/3rd of all US iPhone users were born after 1996 whereas this is only true for 10% of Samsung users. Apple has the most young users with many future purchases ahead and almost 90% of US iPhone owners choose another iPhone as their next smartphone purchase. Apple has pricing power. The original iPhone with a two-year phone carrier contract had a cost of about $450 in 2024 dollars adjusted for inflation but today’s models can sell for far more – up to $1,599.

Better Decisions Moving Forward

This part of the Justice Department complaint highlights Apple’s shaky decisions and I agree their choices have been less than optimal (emphasis added):

Limiting the features and functionality created by third-party developers – and therefore available to iPhone users – makes the iPhone worse and deprives Apple of the economic value it would gain as the platform operator. It makes no economic sense for Apple to sacrifice the profits it would earn from new features and functionality.

Apple’s decision to make things difficult for Spotify (SPOT) over the years has caused resentment. Their Apple Music product should compete on its own merit and not be given unfair treatment. Spotify’s Time To Play Fair Timeline highlights controversial decisions made by Apple over the years. Apple came out with the watch in April 2015 and they knew Apple Music would be available a few months later. As such, they didn’t allow Spotify to make a watch app:

Spotify denied (Spotify’s Time To Play Fair Timeline)

Apple made short-sighted decisions in rejecting Spotify’s innovation efforts. The Justice Department complaint explains how Apple has a history of doing this by abusing the “app review” process and denying access to APIs:

Spotify rejections (Spotify’s Time To Play Fair Timeline)

Anyone who has spent time in China in the last few years knows the US is behind in terms of the way smartphones are used. Part of the reason for this is because Apple has made the bad decision to stifle the types of things which can be done with super apps. In the US we can’t even buy a Kindle book from the iPhone because Apple has decided to be greedy about collecting a tax from Amazon. A June 2020 WSJ article discusses this issue and other problems with restrictions because of Apple’s decisions to be rapacious with their tax. The Justice Department complaint spells out specifics on the extent of the tax:

For most of the last 15 years, Apple collected a tax in the form of a 30 percent commission on the price of any app downloaded from the App Store, a 30 percent tax on in-app purchases, and fees to access the tools needed to develop iPhone native apps in the first place. While Apple has reduced the tax it collects from a subset of developers, Apple still extracts 30 percent from many app makers.

Tencent’s (OTCPK:TCEHY) WeChat is a super app which allows users in China to use their smartphones more efficiently with parking lots, toll roads, menu browsing, restaurant payments, reservations, appointments, subway fares and other considerations. In the past Apple has worried about users being loyal to the brand if super apps can do everything from any type of phone. This is less of an issue now that we have users fully participating in the ecosystem with a phone, a watch and AirPods. Users are willing to pay more for a seamless ecosystem with these products and it is now time for Apple to be more open-minded with decisions tied to super apps. The Justice Department complaint explains how Apple made bad decisions in this area in the past:

Apple has used one or both mechanisms (control of app distribution or control of APIs) to suppress the following technologies, among others: Super apps provide a user with broad functionality in a single app. Super apps can improve smartphone competition by providing a consistent user experience that can be ported across devices. Suppressing super apps harms all smartphone users – including Apple users – by denying them access to high quality experiences and it harms developers by preventing them from innovating and selling products.

Apple markets themselves as a company which prioritizes privacy and restricts intrusive ads. The Justice Department complaint highlights the hypocrisy and greed involved in the Apple decision making process when they charge a large tax for apps and then charge for keyword advertising on top of this (emphasis added):

Apple also generates substantial and increasing revenue by charging developers to help users find their apps in the App Store – something that, for years, Apple told developers was part of the reason they paid a 30 percent tax in the first place. For example, Apple will sell keyword searches for an app to someone other than the owner of the app. Apple is able to command these rents from companies of all sizes, including some of the largest and most sophisticated companies in the world.

The Justice Department complaint goes on to say Apple is more restrictive than necessary with the iPhone whereas they are more reasonable with the Mac. Moving forward, I think Apple should make better decisions in terms of making the iPhone more open like the Mac (emphasis added):

As a point of comparison, Apple does not engage in such conduct on its Mac laptops and computers. It gives developers the freedom to distribute software directly to consumers on Mac without going through an Apple-controlled app store and without paying Apple app store fees. This still provides a safe and secure experience for Mac users, demonstrating that Apple’s control over app distribution and creation on the iPhone is substantially more restrictive than necessary to protect user privacy and security.

Per the NY Times, Apple spent more than $10 billion on their car project which they have since abandoned. Moving forward, they should think about smarter decisions with side projects and concentrate on matters close to their phone and watch ecosystem. Had they spent $10 billion more on AI work then maybe Siri wouldn’t be so terrible with voice to text where I have a contact named Gerry and Siri regularly spells his name as Jerry. There have been numerous times when Siri has gotten confused with simple variations like the difference between “there” and “their.”

Valuation

There has been a tremendous amount of buyback activity over the last 10 years. The fiscal 2014 10-K shows 5,864,840,000 shares outstanding as of October 10, 2014 and there was a 4-for-1 split in 2020 so this is equivalent to 23,459,360,000 shares. The fiscal 2023 10-K shows 15,552,752,000 shares outstanding as of October 20, 2023. Putting these buybacks in perspective, suppose a rich person owned 1% of Apple in 2014 which would be the equivalent of 234,593,600 shares. If that person held on over the years then that person owned more than 1.5% of Apple by October 2023!

Trailing twelve months (“TTM”) net income was $100.9 billion or $33.9 billion + $97 billion – $30 billion on sales of $385.7 billion or $119.6 billion + $383.3 billion – $117.2 billion. Given Apple’s excellent track record of returning value to shareholders, I could see it being worth 25 to 30x TTM net income which is $2.5 to $3 trillion.

Per the 10-Q through December 30th, there were 15,441,881,000 shares outstanding as of January 19, 2024. Multiplying by the March 25 share price of $170.85 gives us a market cap of more than $2.6 trillion. Per the 1Q24 call, the market cap is relatively close to the enterprise value:

We ended the quarter with $173 billion in cash and marketable securities. We decreased commercial paper by $4 billion, leaving us with total debt of $108 billion. As a result, net cash was $65 billion at the end of the quarter.

The market cap is within my valuation range and I think the stock is a hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/V3KCLON3EN6RA4XBMIOWBHMBCA.jpg)