Apple Problem: It’s Underperforming The Index (Technical Analysis, Downgrade) (AAPL) – Technologist

Justin Sullivan

Apple Inc. (NASDAQ:AAPL) is a great company, held in almost every portfolio, including Warren Buffett’s, but it is underperforming the S&P 500 Index (SP500), and that is a problem for portfolio managers who want to beat the Index. AAPL is overvalued and priced to perfection because it is still considered a growth company favorite, deserving a high valuation. It maintains its lofty price level because of a “buy and hold” philosophy that has always worked for its investors. Stock buybacks also help.

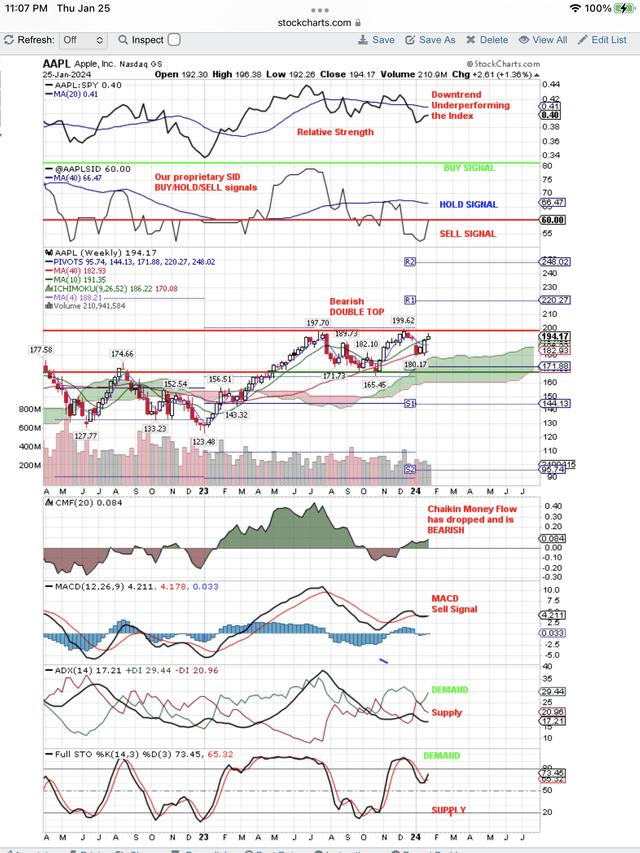

However, portfolio managers who want to beat the Index, will sell stocks that are underperforming the Index on a trend basis. You can see that downward trend happening to AAPL on the weekly chart below. Meanwhile, a weak stock like International Business Machines Corporation (IBM) is coming back to life. Maybe the pairs trade for hedge funds will be to short AAPL and go long IBM.

Our proprietary SID signal uses both fundamentals and technicals to rate a stock. It is shown at the top of the chart below. You can see the SID Sell signal below the red line, is struggling to get back to a weak Hold signal. We like to do our due diligence on AAPL using Seeking Alpha’s analysts and Quant ratings, so let’s dig into them.

SA shows that it’s analysts have a consensus Hold rating, but the two most recent articles have Sell ratings. Meanwhile, back on Wall St. the sell-side analysts still have a consensus Buy rating, but with a target of only $200. That would imply that Wall St. expects AAPL to underperform in 2024, unless that target moves higher. With AAPL’s challenges short term, that does not seem likely.

SA’s Quant ratings are not good. Profitability is great, but Growth and Valuation get poor ratings. This is a deadly combination because you always want to see high growth to offset the valuation problem. In addition, SA ratings are weak for Momentum and Revisions. These two indicate to us that the bearish double top shown on the chart below will stop price and we expect it to drop from here. It is possible that its “magnificent seven” status will take it higher, but then we expect short term, bad news to take it lower. Eventually portfolio selling will overcome the buybacks.

Here is our weekly chart for AAPL. You can see our SID Sell Signal at the top of the chart. Also Relative Strength, AAPL:SPY, shows the downtrend indicating AAPL is underperforming on a trend basis, despite the recent move up to the downtrend line.

Here is our weekly chart with our proprietary SID Sell Signal at the top. You can also see Relative Strength signal at the top of the chart is trending down and underperforming the Index, as represented by SPDR® S&P 500 ETF Trust (SPY):

Our AAPL Sell Signal and it is underperforming the Index. (StockCharts.com)

Conclusion

You can see our Demand signals improving as Apple Inc. makes an attempt to overcome all the negatives. Our proprietary Sell signal along with the downtrend in performance are formidable obstacles. Our due diligence with SA analysts and ratings seems to support our conclusion that AAPL will continue to underperform the Index and portfolio managers will use it as a source of funds to increase holdings in outperforming stocks.