Apple: My Dark Horse Of The Magnificent 7 Could Lead The Pack In The Second Half (AAPL) – Technologist

ozgurdonmaz

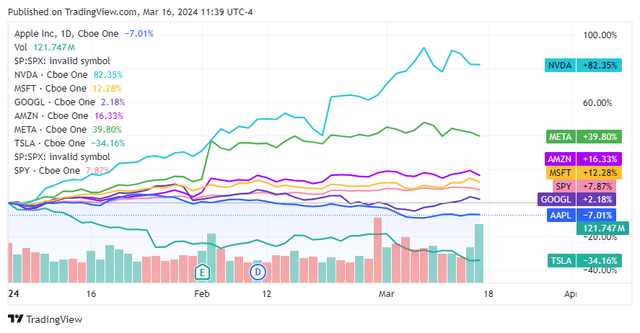

Some questions have been answered, while others remain unanswered about Apple (NASDAQ:AAPL) and the market. While AAPL was once the foundation that kept the market afloat, in 2024, we learned that the market could go higher without participation from AAPL. Some had wondered when an AAPL car would hit the market, and several weeks ago, AAPL announced that the electric vehicle project would be canceled and resources from Project Titan would be redirected to focus on artificial intelligence (AI) initiatives. AAPL shares have declined by 7.01% in 2024 while 5 of the Magnificent 7 are in positive territory, and the SPDR S&P 500 Trust (SPY) is up 7.87% this year. APPL shares are currently caught in a drawdown of -13.53% from their recent highs of $199.62. I think the current sell-off is an opportunity, and while shares could continue lower, I feel AAPL could be the Dark Horse that comes out of nowhere in the 2nd half of 2024 to lead the pack. AAPL is coming off its 2nd most profitable year, and the 2024 fiscal year is starting off stronger than 2023. I don’t believe AAPL’s best days are behind them, and I will be adding to my position as shares decline as I see a long-term opportunity in their ability to change the technology sector.

Seeking Alpha

Following up on my previous Apple Article

AAPL shares have cooled off since my last article was published on 11/6/23 (can be read here). Since then, shares have declined by -2.13%, which underperformed the market as the S&P has appreciated by 17.25%. The total return after AAPL’s dividend in this period is -1.88%, as AAPL hasn’t participated in the recent leg of the rally. In that article, I discussed why the negative top-line growth wasn’t a problem for me, as I was more focused on AAPL’s profitability and the ability to grow its EPS. We have seen this before from AAPL as revenue declined YoY in 2019 before a massive 3-year spurt. I am not a short-term investor, and in many cases, my investment horizon is based on a 5–10-year outlook. I wanted to follow up with a new AAPL article because a lot of news has been released, AAPL is starting 2024 out in a stronger position than they did in 2023, and I think AAPL is setting up for another growth spurt over the next several years. Shares of AAPL could decline further, but ultimately, I believe AAPL could be a Dark Horse in the Magnificent 7, and the back half of the year may shock some investors.

Seeking Alpha

The risks to investing in Apple

Risk and AAPL aren’t frequently used in the same sentence, but every investment comes with some type of risk, even the mighty AAPL. We have seen opportunity cost as a risk in recent months as investing in a standard S&P 500 index fund has drastically outperformed individual shares of AAPL since November. There is also a different type of opportunity cost, which falls on the shoulders of Tim Cook and the executive leadership at AAPL. I don’t think anyone is going to complain about AAPL spending billions on Project Titan only to cancel the project, but this certainly diverted resources away from other areas, both monetary and in human capital. AAPL isn’t a player in the public cloud space, and while they have cloud storage for users, they don’t have an enterprise-level solution the way Microsoft (MSFT) has Azure or Amazon (AMZN) has AWS. AAPL also hasn’t allocated enough resources to date to be a frontrunner in AI, and the opportunity cost for AAPL is that a significant amount of time has been lost, and the competition is embedded throughout these markets. AAPL is also facing lawsuits, and depending on how things shape up with the AAPL store, we could see both AAPL and Alphabet (GOOGL) incur a loss of revenue from in-app purchases. The main risk now is that AAPL has hit its peak and is going to tread water to maintain its current position rather than replicating the innovation that made it the largest company in the world.

Apple is setting the tone with the offence, and 2024 is starting off strong

When you purchase a share of common stock, you’re an equity owner in a company. It doesn’t matter if you purchase a fractional share, a whole share, or 10,000 shares, the equity that you purchase represents a portion of the revenue and earnings the company purchases. At today’s prices, you’re paying $172.62 per share, which is the current value for all the future cash flow AAPL will generate. AAPL is the most profitable company in the market, followed by Berkshire Hathaway (BRK.B), and while it looks like a risk on the environment is emerging in anticipation of entering a lower-rate environment, AAPL is setting the tone for 2024 with immense profitability.

When I purchase shares in a company, I look at it as owning the underlying entity and the cash-producing operations as 2 separate aspects. When you purchase shares of AAPL, you’re buying in a company that has $40.76 billion in cash, and $32.34 billion in short-term marketable securities, which places their on-hand liquidity at $73.1 billion. Then there is another $99.48 billion in marketable securities under its long-term assets, which brings its total current and non-current cash position to $172.58 billion. There is another $180.94 billion in assets on the balance sheet, and when the liabilities are deducted, the amount of shareholder equity left is $74.1 billion. AAPL has $95.09 billion in term debt on its balance sheet, and while they could write a check and eliminate it tomorrow, its profitability allows them to pay it down as it matures and incur the interest as the cost of doing business due to their level of profitability.

After looking at the balance sheet, AAPL’s operating business generated $383.29 billion in revenue for the 2023 fiscal year. AAPL produced $169.15 billion in gross profit for a gross profit margin of 44.13%, and after their operating expenses are considered, AAPL is operating at a 29.82% operating margin as its operating income came in at $114.3 billion. The amount of debt on AAPL’s balance sheet doesn’t matter since they generated $125.82 billion in EBITDA, which works out to $2.42 billion in EBITDA per week. To put that into perspective, AAPL is generating more in EBITDA on a weekly basis than many companies produce in a quarter or in some cases, their entire fiscal year. After all the interest expenses and corporate taxes are factored in, AAPL generated $97 billion in net income for 2023, which is $1.87 billion per week in pure profitability. This is why I wish more investors would look past the headlines and look into the financial statements further. Unless you’re a trader or swing investor, selling off AAPL as a long-term investor doesn’t make a lot of sense.

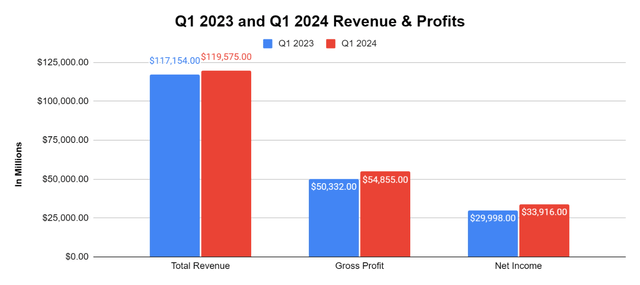

I am still perplexed as to why investors are losing faith in AAPL after they set the tone with the offense for 2024. In the first quarter of the 2024 fiscal year, AAPL delivered growth across the board from the top line to the bottom line. AAPL generated $119.58 billion in revenue, which was a YoY increase of 2.07% ($2.42 billion). AAPL increased its gross profit by 8.99% ($4.52 billion) YoY to $54.86 billion, which put its gross profit margin at 45.87%. Looking at the bottom line, AAPL delivered a jump of 13.06% ($3.92 billion) in net income YoY to $33.92 billion. On a per-share basis, AAPL was able to grow its basic EPS by $0.30 or 15.87% YoY to $2.19 in Q1.

Steven Fiorillo, Seeking Alpha

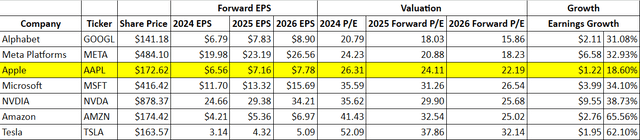

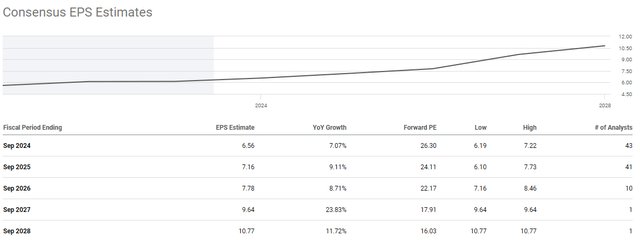

The combination of AAPL’s increased profitability and analyst forward estimates has put AAPL closer to a value play. AAPL is trading at 26.31 times their projected 2024 earnings, which is the 3rd lowest valuation in the Magnificent 7. The average forward multiple for the Magnificent 7’s 2024 forward earnings is 33.72 times, which is significantly under AAPL. Looking out to 2026, AAPL trades at 22.19 times their 2026 earnings. If shares of AAPL continue to decline in value and AAPL beats earnings estimates over the next several quarters, then shares could end up trading at less than 20 times their 2026 forward earnings. AAPL has roughly 18.6% of EPS growth on the horizon over the next 2 years, and after setting the tone with the offense in Q1, I think shares look very attractive.

Steven Fiorillo, Seeking Alpha Seeking Alpha

Apple’s innovation isn’t over and I believe they will replicate what they did with Services through a combination of investments, AI, and the Apple Vision Pro

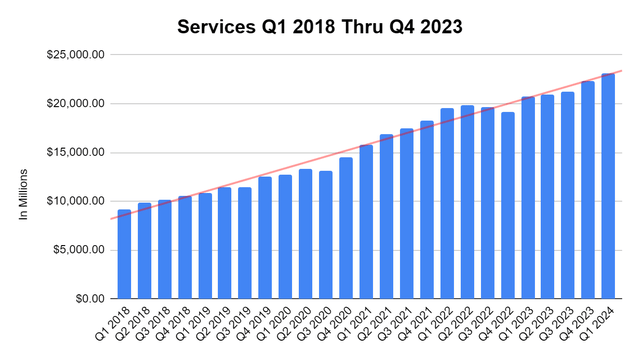

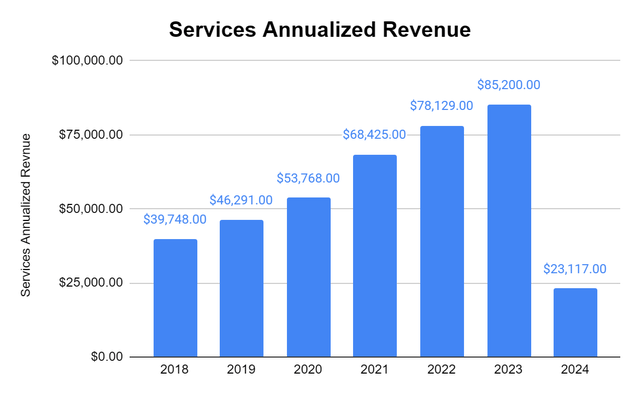

I don’t feel that the Services business gets enough credit as AAPL has done a fantastic job at generating a reoccurring revenue stream that is on pace to generate $100 billion in 2025. Over the past 6 years, AAPL has increased its Q1 Services revenue by $13.99 billion (153.23%) as its increased from $9.13 billion to $23.12 billion. In 2023, the annualized services revenue increased by 9.05% or $7.07 billion YoY, and in 2024, AAPL is starting out the year by producing 27.13% of its 2023 services revenue in Q1. In the past 6 years, there has only been 1 time where Q4 revenue generated from Services didn’t exceed Q1. Services have become a critical component of AAPL’s revenue mix as it is helping diversify away from generating the majority of revenue from iPhone sales.

Steven Fiorillo, Apple Steven Fiorillo, Apple

AAPL delivered the Apple Vision Pro and recently acquired a Canadian startup company DarwinAI, after announcing it would redirect resources from Project Titan to their AI initiatives. AAPL’s upcoming WWDC conference in June is rumoured to focus on generative AI as AAPL could announce new AI tools as part of iOS 18 and a revamped version of SIRI. To think AAPL doesn’t have the ability to innovate the computing space further is a bit shortsighted, considering they have revolutionized the smartphone industry and mobile computing through their tablets. AAPL generates close to $100 billion in annualized profits and has more than $170 billion in liquidity on their balance sheet. AAPL has the means and the engineering proficiency to drive the narrative in future computing.

I believe the next leg of AAPL’s expansion will be through a combination of hardware sales and increased Services subscriptions. Over the next several years, I see the Apple Vision Pro becoming the size of a pair of Oakley or Ray-Ban sunglasses powered by the iPhone. I think AAPL may acquire brands such as Warner Bros. Discovery (WBD) and the Madison Square Garden Sports Corp. (MSGS) for the content libraries and to take these pieces off the table. I think AAPL could get into live sports and expand their Apple TV offerings considerably with acquisitions such as these, as well as sell virtual season tickets to the Knicks and Rangers through Apple Vision Pro. In its current form, it’s just too big, but nobody has a problem wearing glasses for most of the day. I think that mixed reality and virtual computing will lead to increased hardware sales and recurring Services subscriptions for AAPL.

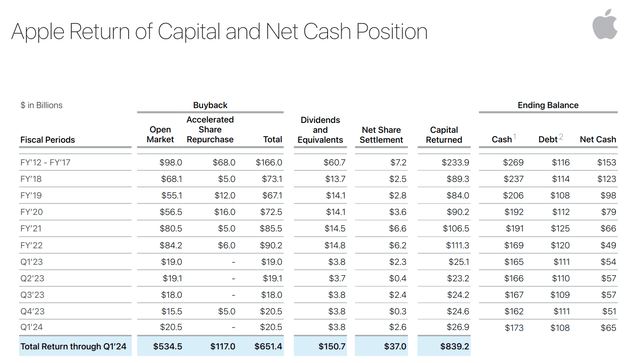

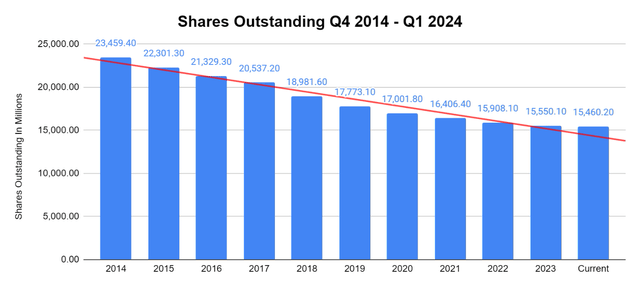

The next wave of computing could fuel a jump in revenue and profitability the way that we saw in AAPL’s 2021 fiscal year. This could lead to a larger return of capital and more acquisitions in AAPL’s future. Since the 2012 fiscal year, AAPL has returned $839.2 billion to shareholders, of which $651.4 billion was allocated toward buybacks. Over the past decade, AAPL has repurchased 34.1% of its shares outstanding as they decreased the float by 8 billion shares. I don’t think AAPL is going to sit out of the bull market much longer, but they will figure out a way to embed AI into their products and transcend screens in computing. When I think about all of the information that AAPL has on its consumers, I think we will see an evolution in SIRI that allows consumers to harness AI, and they may even create service packages for different types of assistant programs.

Apple Steven Fiorillo, Seeking Alpha

Conclusion

As investors have gravitated toward companies such as AMZN, Nvidia (NVDA), and Meta Platforms (META), AAPL has been left out of the recent rally as shares are in the red to start 2024. While many are writing AAPL off, I think AAPL could be the Magnificent 7’s dark horse in 2024 that investors don’t see coming. Now that the aspirations of a self-driving EV are finished, AAPL can deploy its resources to the next generation of computing and AI. While shares could get cheaper, I think paying 26.31 times 2024 earnings and 22.19 times 2026 earnings for AAPL will prove to be a solid long-term investment. AAPL already has the consumer-level infrastructure for AI, and I think they will deliver in a big way over the next several years. AAPL will likely keep buying back tens of billions worth of shares each quarter, and as they increase their operational earnings, they will likely beat analyst estimates. Once again, the street could place AAPL on a pestle. I think we will see a second-half rally after the upcoming WWDC conference, and these prices will prove to be a gift over the long term.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/VPJQUK43R6MFUGTVE5L3RKMVNA.jpg)