Apple: DOJ Antitrust Lawsuit – Potential Fallout, Upcoming GenAI Supercycle – Technologist

Anna Moneymaker/Getty Images News

Have you missed the boat on Apple Inc. (NASDAQ:AAPL)? AAPL has been a stock which has seemingly soared higher and higher in spite of perennially trading at rich valuations. The stock’s voracious run, however, has hit a bit of a pause as it is one of the lone mega-cap tech titans which continues to trade below all-time highs. The stock has gone nowhere ever since 2021, and this underperformance may have created an attractive buying opportunity. Meanwhile, the Department of Justice (‘DOJ’) is set to finally launch its antitrust lawsuit against the company, which may rattle investors already concerned with the valuation. In this report, I explain why I am upgrading the stock on account of a potential generative AI supercycle, as I expect the company’s long-term track record of execution will outweigh any potential fallout from antitrust proceedings.

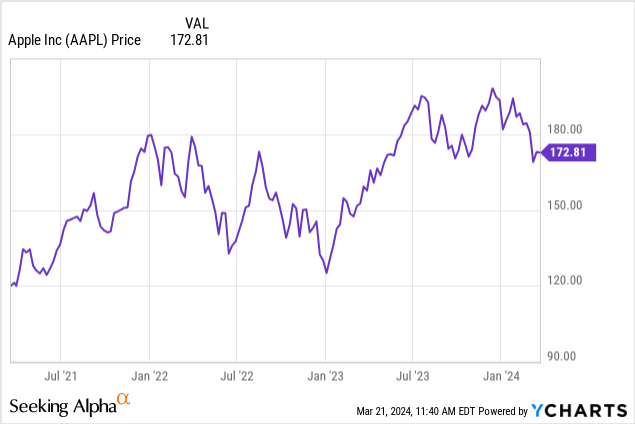

AAPL Stock Price

I last covered AAPL in September where I explained why I was downgrading the stock due to valuation and potential geopolitical risks. The stock has since underperformed the broader market by around 20%.

That underperformance has made the stock significantly more attractive than before from a valuation perspective, and I am coming to appreciate the potential delayed boom as the company eventually cashes in on generative AI.

DOJ To Launch Antitrust Lawsuit Against Apple

The DOJ is expected to sue AAPL for violating antitrust laws as soon as Thursday. This lawsuit is expected to lead to a hefty fine and potential business model changes. Before investors rush to dismiss the lawsuit as without merit, it must be noted that AAPL’s stock trades at such a rich valuation in large part due to its rather monopolistic hold on its ecosystem. The company has not shown strong top-line growth rates in recent years, yet has consistently commanded an earnings multiple around 30x due to Wall Street’s high confidence in the ecosystem. As an Apple user myself, I can relate to the notion that the company takes clear steps to “lock me in” to the ecosystem, be it through using Apple software like the Safari browser and having to use the Apple Watch to track sleep. I also shouldn’t ignore the infamous “iMessage lock-in” which has apparently contributed partly to bullying in schools. I would not be surprised if Apple is forced to adjust these policies which might increase churn rates and eventually lead to pricing pressures on its devices. While I am of the view that the long-term impact will likely be less significant than feared, the uncertainty regarding the impact might lead to a valuation overhang – the severity of that multiple contractions might weigh on the stock.

Apple Stock Key Metrics

In its most recent quarter, AAPL delivered 2% YoY revenue growth, led by 11% growth in Services revenues. The company also saw Mac sales grow 0.6%, marking a substantial recovery given the segment’s prior onslaught as well as the fact that the company had one less week as compared to the prior year. Due to share repurchases, earnings per share grew much faster at 16% to $2.18. The company ended the quarter with $173 billion in cash versus $108 billion in debt, helping to fund $20 billion in share repurchases. When the stock was soaring and soaring, investors willingly overlooked the use of capital on share repurchases, but I suspect some investors may be wondering why the company continues to repurchase stock given its relative premium to the market.

On the conference call, management guided for the next quarter to see rather muted results, as they will now face tough comparables for Mac revenue growth. Management expects a “similar double-digit growth rate” for Services – but like many other tech companies, investors may have to wait a little longer for any potential tailwinds from generative AI.

Is AAPL Stock A Buy, Sell, or Hold?

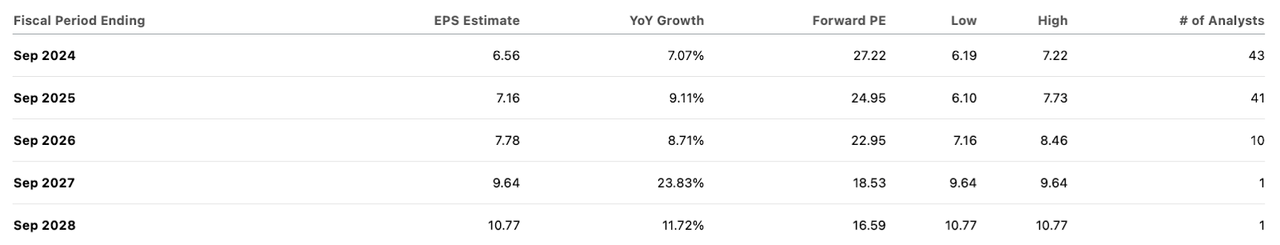

At recent prices, AAPL was trading at 27x this year’s earnings.

Seeking Alpha

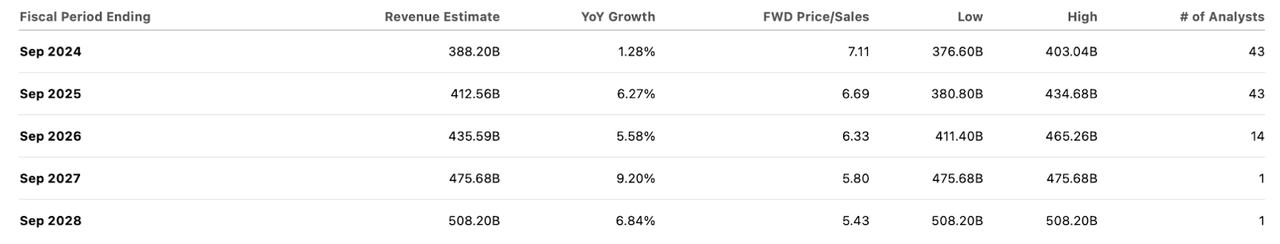

That earnings multiple looks lofty given that consensus estimates call for single-digit top-line growth moving forward.

Seeking Alpha

I do not deny that AAPL continues to trade at a premium to the broader market. While I am upgrading the stock today, I emphasize that the stock does not trade at “pound the table” kind of prices. That said, I am finally of the view that consensus estimates are too conservative as they do not appear to appreciate the likelihood that the company benefits from a generative AI supercycle. The company was recently in the news due to a report implying that the company may be in discussions with Alphabet Inc. (GOOG) (GOOGL) to allow Gemini to power generative AI on iPhones. Just as enterprises across the world have rushed to embrace generative AI capabilities, I expect consumers to rush to get generative AI capabilities on their mobile devices. I am doubtful that Apple will make these capabilities immediately available on old devices (there may be technological constraints as well), meaning that consumers may likely have to replace their devices with new generative AI-enabled products, which may even carry a hefty price tag. In addition to leading to several years of elevated iPhone profits, there may also be a wave of growing generative AI applications and subscription fees. I expect this generative AI boom to more than offset any impact from the DOJ antitrust lawsuit, as the stock may deliver solid returns even if multiples end up contracting some.

What are the key risks? It is impossible to accurately predict what will happen from the DOJ antitrust lawsuit. Perhaps the consequences will be more serious than imagined and AAPL may lose its strength as a consumer brand. It is possible that the company is unable to convince consumers to upgrade to generative AI-enabled devices, or that consumers end up switching to Android competitors due to lower prices. The stock continues to heavily hinge on maintaining high valuation multiples, but that thesis might break down if Wall Street returns to viewing the company as it did prior to 2015.

I am upgrading the stock to a buy rating as I view generative AI to not be priced into the stock, and view any pullback related to the DOJ antitrust lawsuit as a buying opportunity.